Paid Stock Monitoring Application (Full version)

₹5,999.00 Original price was: ₹5,999.00.₹1,999.00Current price is: ₹1,999.00.

- Real-time Data Monitoring:

- Automated Trading Alerts:

- Trailing Stop-Loss and Exit Strategies:

- Comprehensive Report Generation:

- User-Friendly Interface:

- Stopping Monitoring:

- Saving and Loading Settings:

- Generating Reports:

Description

Frequently asked question

Most advanced Breakout alert software

- Login:

- Open the application and ensure you have properly understood this how to setup.

- Setting Up:

- Enter your Telegram Token and Chat ID in the respective fields.

- Specify the quantity and threshold for trades.

- Configure the report interval to receive regular updates on your portfolio.

- Configuring Strategies:

- Define the breakout start and end times for up to three strategies.

- Set loop counts to determine how many times each strategy should be executed.

- Enable or disable each strategy based on your preference.

- Selecting Stocks:

- Choose from a predefined list of stocks, including indices, futures, and options.

- Alternatively, load stocks from a text or CSV file for custom monitoring.

- Starting Monitoring:

- Click the “Start Monitoring” button to begin tracking your selected stocks.

- The application will display real-time data and send alerts as your strategies are triggered.

- Stopping Monitoring:

- To stop monitoring, simply click the “Stop Monitoring” button.

- The application will gracefully end the monitoring process and finalize any open positions.

- Saving and Loading Settings:

- Save your configuration for future use by clicking the “Save Settings” button.

- Load previously saved configurations by clicking the “Load Settings” button.

- Generating Reports:

- The application automatically generates and sends profit/loss reports at your specified intervals.

- You can also view the reports directly within the application interface.

Best Practices

- Double-Check Your Settings: Always review your strategy settings and selected stocks before starting the monitoring process.

- Monitor Regularly: Although the application automates much of the process, keeping an eye on your trades can help you make timely decisions.

- Utilize Trailing Stop-Loss: This feature is valuable for locking in profits as your trades move in the right direction.

Support

If you encounter any issues or need assistance, please contact our support team:

- Email: support@excelalgotrader.in

- Phone: 8553029884

- Website: www.excelalgotrader.in

Conclusion

The Stock Monitoring and Trading Application is designed to make your trading experience more efficient and profitable. With its robust features and user-friendly interface, you can confidently manage your trades and focus on maximizing your returns. Happy Trading!

Introduction

Welcome to the Stock Monitoring and Trading Application, a comprehensive tool designed to help you efficiently monitor stock market movements and automate your trading strategies. This application integrates real-time data fetching, strategy execution, and automated alerts, making it an ideal solution for both seasoned traders and beginners.

Key Features

- Real-time Data Monitoring:

- Fetch and analyze data from multiple stocks simultaneously.

- Support for stocks futures and options data.

- Detailed monitoring of market prices with customizable breakout strategies.

- Automated Trading Alerts:

- Receive buy/sell alerts based on predefined breakout strategies.

- Customize alerts for different stocks and strategies.

- Alerts are sent directly to your Telegram account with detailed information.

- Trailing Stop-Loss and Exit Strategies:

- Enable trailing stop-loss to protect your profits as the market moves in your favor.

- Option to exit at the first target or continue monitoring with trailing stop-loss.

- Comprehensive Report Generation:

- Generate detailed profit/loss reports, including both open and booked positions.

- Receive periodic updates on your portfolio’s performance via Telegram.

- User-Friendly Interface:

- Intuitive and customizable front-end interface.

- Select multiple stocks, set strategy parameters, and control the monitoring process with ease.

- Save and load your settings for future use.

A Breakout Strategy is a trading approach where the trader attempts to enter a position when the price breaks through a defined level of support or resistance. The key assumption is that when the price breaks through these levels, it will continue to move in the direction of the breakout, providing an opportunity for profit.

1. Key Concepts in Breakout Strategy

- Support Level: A price level where a stock typically does not fall below, as buyers are expected to enter the market. It’s often considered a “floor” for the stock price.

- Resistance Level: A price level where a stock typically does not go above, as sellers are expected to take profits or prevent the price from rising further. It’s often considered a “ceiling” for the stock price.

- Breakout: When the stock price moves above a resistance level or below a support level, it’s called a breakout. Traders view this as an opportunity to enter a trade, assuming the price will continue moving in that direction.

- Breakout Range: The period during which the highest and lowest prices are determined, usually during the first few minutes after the market opens (e.g., 9:15 AM to 9:30 AM). This helps to identify the resistance (high) and support (low) levels for the breakout.

2. How the Breakout Strategy Works in Excel Algo Trader

The Excel Algo Trader software implements the breakout strategy using Opening Range Breakout (ORB) logic, which tracks the stock’s price during the first few minutes of market activity and identifies key breakout levels. Here’s how the system works:

Step-by-Step Process:

1. Breakout Time Frame Setup:

- User Configuration: In the Excel Algo Trader, users can define a specific breakout time range, such as 9:15 AM to 9:30 AM, which is when the highest and lowest prices are tracked to identify the breakout levels (resistance and support).

- High and Low Identification: The system will monitor the stock’s prices during the breakout period and determine:

- High (Resistance): The highest price the stock reached during the breakout period.

- Low (Support): The lowest price the stock reached during the breakout period.

2. Breakout Strategy Logic:

- Buy Breakout (When Price Breaks Resistance): If the price breaks above the high (resistance level) after the breakout period ends, the system generates a buy alert. The assumption is that the price will continue moving upward after breaking resistance.

- Sell Breakout (When Price Breaks Support): If the price drops below the low (support level), the system generates a sell alert. The assumption is that the price will continue moving downward after breaking support.

The strategy involves placing an order immediately when the breakout happens to capitalize on the momentum of the price movement.

3. Trade Management:

- Stop-Loss: For both buy and sell breakouts, a stop-loss is placed at the opposite breakout level (e.g., the support level for a buy breakout or the resistance level for a sell breakout) to minimize risk.

- Target Price: The target price is typically set based on the size of the breakout range (the difference between the high and low). For example, if the breakout range is 10 points, the target could be set at a price that is 10 points above the buy level (for a buy trade) or 10 points below the sell level (for a sell trade).

- Trailing Stop-Loss: If enabled, the trailing stop-loss will adjust upward (for buy trades) or downward (for sell trades) as the price moves in the trader’s favor, locking in profits while allowing the trade to continue capturing gains.

3. Breakout Strategy Example in Excel Algo Trader

Let’s go through a detailed example to understand how the breakout strategy is implemented in practice.

Example Stock: Reliance Industries Ltd (RELIANCE.NS)

Breakout Time Window:

- Start: 9:15 AM

- End: 9:30 AM

Breakout Range: During the breakout time window (9:15 AM to 9:30 AM), the following prices were recorded:

- High (Resistance): ₹2500

- Low (Support): ₹2480

- Breakout Range: ₹2500 – ₹2480 = ₹20 range.

Breakout Levels:

- Resistance Level: ₹2500

- Support Level: ₹2480

Threshold: Let’s say the user has set a threshold of ₹2. This means that the system will consider a breakout valid only if the price moves ₹2 above the high or ₹2 below the low.

Scenario 1: Buy Breakout

- Price Movement: After 9:30 AM, the stock price breaks above ₹2500 and hits ₹2502.

- Buy Alert: The Excel Algo Trader system triggers a buy alert and enters a buy trade at ₹2502.

- Stop-Loss: The stop-loss is automatically set at ₹2480 (the low of the breakout range).

- Target: The target price is set at ₹2502 + ₹20 (breakout range) = ₹2522.

Trade Example:

- Entry Price: ₹2502 (Buy)

- Target Price: ₹2522

- Stop-Loss: ₹2480

Outcome:

- If the stock moves up and hits ₹2522, the system exits the trade and books a profit of ₹20 per share.

- If the stock price falls back to ₹2480, the system triggers the stop-loss, and the loss is capped at ₹22 per share.

Scenario 2: Sell Breakout

- Price Movement: After 9:30 AM, the stock price falls below ₹2480 and hits ₹2478.

- Sell Alert: The Excel Algo Trader system triggers a sell alert and enters a sell trade at ₹2478.

- Stop-Loss: The stop-loss is automatically set at ₹2500 (the high of the breakout range).

- Target: The target price is set at ₹2478 – ₹20 (breakout range) = ₹2458.

Trade Example:

- Entry Price: ₹2478 (Sell)

- Target Price: ₹2458

- Stop-Loss: ₹2500

Outcome:

- If the stock moves down and hits ₹2458, the system exits the trade and books a profit of ₹20 per share.

- If the stock price rises back to ₹2500, the system triggers the stop-loss, and the loss is capped at ₹22 per share.

4. Breakout Strategy with Trailing Stop-Loss

Let’s revisit the buy breakout scenario with trailing stop-loss enabled:

- Price Movement: After buying at ₹2502, the price rises to ₹2510, then to ₹2515, and finally hits ₹2520.

- Trailing Stop-Loss Activation: The trailing stop-loss adjusts as the price moves upward. If the price hits ₹2520, the stop-loss may have moved up from ₹2480 to ₹2500 (cost-to-cost level).

- Profit Lock-In: If the price reverses after hitting ₹2520, the trailing stop-loss ensures that the trade is exited at ₹2500, locking in a small profit instead of a potential loss.

5. Advantages of Breakout Strategy

- Capitalizing on Momentum: Breakouts often signal strong momentum, which can lead to significant price movements. The strategy allows traders to ride these moves and capture profits.

- Defined Risk: With stop-loss levels placed at the opposite end of the breakout range, traders know exactly how much they stand to lose in each trade.

- Customizable for Different Timeframes: The breakout strategy can be adjusted for different timeframes, making it suitable for intraday traders, swing traders, or even longer-term investors.

6. Conclusion

The breakout strategy in Excel Algo Trader is a powerful tool for traders looking to capitalize on price movements when a stock breaks through key levels of support or resistance. With its customizable settings for breakout times, thresholds, stop-loss levels, and target prices, it offers a flexible and automated approach to trading. Combined with real-time monitoring, alerts, and risk management features, the breakout strategy provides a solid framework for making data-driven trading decisions.

Overview:

The Excel Algo Trader is an advanced stock monitoring and trading tool integrated with Telegram for alerts, It allows users to monitor stocks based on customizable breakout strategies and automatically generate profit/loss reports. This manual explains the features, setup, and usage of the software.

1. Main Features:

- Stock Monitoring: Select multiple stocks for monitoring with real-time price data.

- Telegram Alerts: Get real-time alerts for buy/sell triggers and profit/loss reports via Telegram.

- Trailing Stop-Loss: Adjust stop-loss levels dynamically as the stock price moves in your favor.

- Breakout Strategies: Configure up to 3 breakout strategies with customizable timeframes and thresholds.

- Profit/Loss Reports: Receive periodic profit/loss reports directly to your Telegram.

- Settings Management: Save and load settings for quick access to previous configurations.

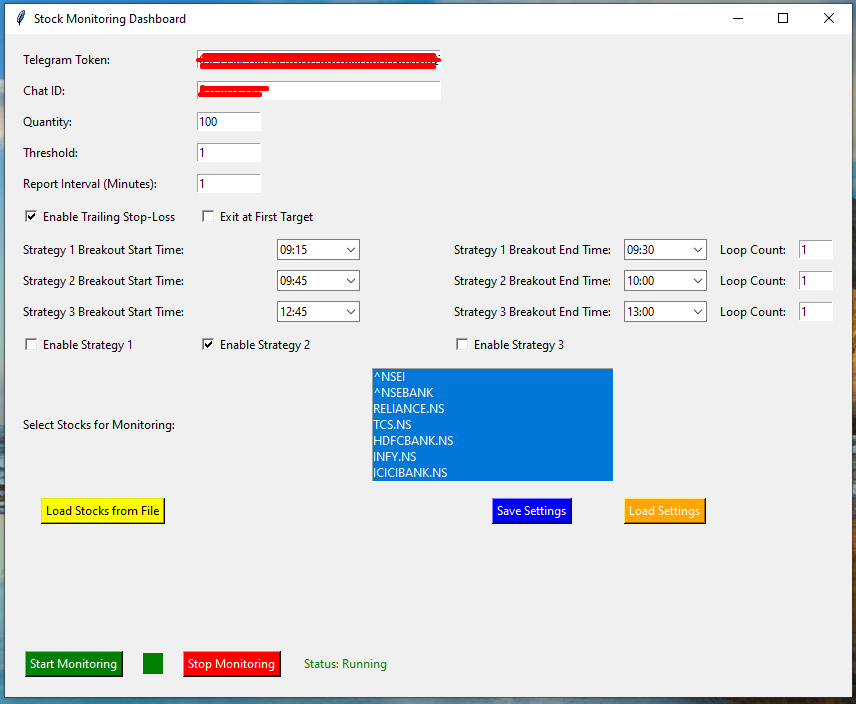

2. User Interface Overview:

Main Window:

| Component | Description |

|---|---|

| Telegram Token | Enter your Telegram bot token. |

| Chat ID | Enter the chat ID where you want to receive messages. |

| Quantity | Number of stocks/contracts to trade per order. |

| Threshold | The price threshold for breakout strategies. |

| Report Interval | Time interval (in minutes) between profit/loss reports. |

| Enable Trailing SL | Checkbox to enable/disable trailing stop-loss. |

| Exit at First Target | Checkbox to exit the trade once the first target is reached. |

| Strategy Breakout Times | Configure the start/end time for breakout strategies. |

| Loop Count | Number of times the strategy should loop during monitoring. |

| Stocks List | Listbox to select stocks for monitoring. |

| Start/Stop Monitoring | Buttons to start or stop monitoring stocks. |

| Save/Load Settings | Buttons to save/load current settings to/from a JSON file. |

| Report Box | Displays real-time status and alerts. |

3. How to Use the Software:

Configuring Telegram Bot:

- Create a new bot using BotFather on Telegram and get the bot token.

- Enter the bot token in the Telegram Token field.

- Find your chat ID by sending a message to the bot and using a Telegram API method.

- Enter the chat ID in the corresponding field.

Selecting Stocks for Monitoring:

- You can load stocks from a

.txtor.csvfile using the Load Stocks from File button. - Alternatively, select stocks manually from the Select Stocks for Monitoring list.

- These stocks will be monitored once the program is started.

Configuring Breakout Strategies:

- For each strategy, specify the Start Time, End Time, and Loop Count.

- Example:

- Strategy 1: Monitor stock price between 09:15 and 09:30 with 1 loop.

- Strategy 2: Monitor from 09:30 to 10:00 with 2 loops.

Starting and Stopping Monitoring:

- Start Monitoring: Click the Start Monitoring button to begin monitoring based on your selected stocks and strategies.

- Stop Monitoring: Click Stop Monitoring to stop the monitoring process.

Saving and Loading Settings:

- Use the Save Settings button to save the current settings (stocks, strategies, etc.) to a JSON file.

- Use the Load Settings button to load saved settings from a file and automatically fill all fields.

4. Advanced Settings:

Trailing Stop-Loss:

- If Enable Trailing Stop-Loss is checked, the system will adjust the stop-loss as the price moves in your favor.

- This prevents premature exits and allows for maximizing profits during strong price movements.

Exit at First Target:

- If Exit at First Target is checked, the system will exit the position as soon as the first target is hit.

- This is useful for users who prefer to lock in profits as soon as the price reaches a predefined level.

Periodic Profit and Loss Reports:

- The software sends profit/loss reports to Telegram at regular intervals based on the Report Interval setting (in minutes).

- Example: If you set it to 30, you will receive a report every 30 minutes with updates on open and booked positions.

5. Troubleshooting:

Common Issues:

Telegram Message Not Sending:

- Double-check that your bot token and chat ID are correct.

Data Fetching Issues:

- If Yahoo Finance data fetching fails, ensure that your internet connection is stable and that the stock symbol is valid.

Program Not Starting:

- Ensure all fields (Telegram Token, Chat ID, Stocks, etc.) are filled in before starting the monitoring.

Logs:

- Check the

stock_monitoring.logfile for detailed logs about any issues encountered during monitoring.

Support:

For further assistance, please visit www.excelalgotrader.in or contact 8553029884.

The Excel Algo Trader is a robust stock monitoring and trading system that integrates several cutting-edge features, allowing users to efficiently manage, monitor, and automate their stock trading strategies. Below are the detailed product features that set it apart from other trading tools:

1. Stock Monitoring & Real-Time Data Integration

- Real-Time Price Monitoring: Stocks selected for monitoring are tracked in real-time. Users can observe real-time price changes and make data-driven decisions based on market movements.

- Multi-Timeframe Breakout Strategy: The software allows users to define up to three custom breakout strategies with different start and end times to monitor stock price movements over specific periods.

- Threshold-Based Alerts: Users can set price thresholds for each stock. The system will alert the user when the stock price crosses the defined high or low thresholds within the breakout timeframes.

2. Telegram Alerts and Notifications

- Real-Time Trade Alerts: As soon as a stock hits a predefined breakout level, the system sends an immediate alert to the user’s Telegram account, detailing the stock, entry price, stop-loss, and target price.

- Customizable Alerts: Alerts can be customized for both buy and sell triggers, giving users flexibility to decide when and how they wish to be notified.

- Profit & Loss Notifications: Receive regular updates on the profit/loss (PnL) of your current positions through periodic Telegram messages, configured by the user.

- Timestamped Alerts: Each alert message includes a timestamp, so users can track exactly when trades are triggered.

3. Breakout Trading Strategies

- Opening Range Breakout: The system implements a breakout trading strategy, identifying key price levels (highs and lows) within the defined breakout period. If the stock price moves above the high or below the low during the defined period, a trade is triggered.

- Multi-Strategy Support: Supports up to three different breakout strategies with individual time windows for monitoring. This allows users to implement multiple strategies simultaneously on different stocks.

- Automated Buy/Sell Decisions: The system monitors predefined levels and automatically alerts users when breakout levels are breached, with detailed trade suggestions.

4. Trailing Stop-Loss

- Dynamic Risk Management: The trailing stop-loss feature dynamically adjusts the stop-loss level as the stock price moves in your favor, locking in profits as the stock price increases.

- Configurable Trailing Phases: Trailing stop-loss is implemented in phases, adjusting the stop-loss when the stock price hits specific profit targets, ensuring that users can capture as much profit as possible without risking large losses.

- Automatic Stop-Loss Adjustments: When a stock hits certain profit levels, the system will automatically adjust the stop-loss, reducing the risk of premature exits while maximizing potential gains.

5. Exit at First Target

- Simple Profit Capture: If users prefer a straightforward exit strategy, the “Exit at First Target” option allows them to close the trade as soon as the stock reaches the predefined target price.

- Customizable Target Levels: Users can set their own target levels for each trade. Once the stock price hits that target, the system exits the trade, locking in profits.

6. Periodic Profit & Loss Reports

- Automated Reporting: At regular intervals (customizable in minutes), the software generates profit and loss (P&L) reports summarizing open and closed positions. These reports are sent directly to the user’s Telegram.

- Open Position Overview: Reports include details of open positions, showing entry price, current price (LTP), stop-loss, target, and real-time MTM (Mark-to-Market) profit or loss.

- Closed Position Summary: Closed positions show the profit or loss booked, along with exit prices and the net result of the trade.

7. Stock Selection and Watchlist Management

- Load Stocks from File: Users can load a list of stocks to monitor from a

.txtor.csvfile. This allows for quick configuration when monitoring a large number of stocks. - Preloaded Watchlist: The software comes with a default set of stocks from the Nifty 50 and other key indices, including stocks like Reliance, TCS, HDFC, and ICICI Bank, making it easier to start monitoring popular stocks immediately.

- Multi-Stock Monitoring: Select multiple stocks for simultaneous monitoring, allowing the user to manage several positions at once.

8. Customizable Settings and Strategies

- Save and Load Settings: Users can save their monitoring and strategy settings to a JSON file, which can be loaded later. This feature allows quick configuration without re-entering stock lists and breakout times.

- Configurable Strategy Parameters: All key parameters, such as breakout start and end times, loop counts, thresholds, and quantity, are fully customizable, giving users flexibility over their trading strategy.

9. Detailed Trade Logs and Reports

- Comprehensive Logging: The software logs all activities, including trade alerts, profit/loss updates, and system status. These logs are stored in

stock_monitoring.log, which can be used for post-trade analysis. - Daily P&L Reports: The end-of-day profit and loss report summarizes the total number of trades, wins, losses, and net profit/loss. This ensures that users have a clear view of their trading performance.

- Visual Trade Reporting: With a built-in text report window in the UI, users can see real-time updates on trades directly within the software.

10. Graphical User Interface (GUI)

- User-Friendly Dashboard: The software features a well-organized dashboard where users can enter Telegram credentials, configure breakout strategies, and select stocks for monitoring.

- Real-Time Report Display: The report section of the dashboard updates in real-time, showing trade alerts, stock updates, and profit/loss calculations.

- Settings Management: The interface includes options to save and load previous settings, making it easy for users to switch between different configurations.

11. Security and User Control

- Two-Factor Authentication via Google: The Google Sheets authentication ensures that only authorized users can access the software. The user is authenticated against a pre-populated Google Sheet with a list of valid members.

- Encrypted Credentials: User credentials are securely stored, ensuring no sensitive information is exposed.

12. System Notifications and Error Handling

- Error Logging: Any errors encountered during the monitoring process (such as stock symbol not found or data fetching issues) are logged, and the user is notified through Telegram and the GUI.

- Actionable Alerts: All alerts include timestamps and detailed information, making it easier for users to act on them promptly.

With these features, the Excel Algo Trader offers a comprehensive, automated solution for traders looking to implement breakout strategies, manage risk with trailing stop-loss, and receive real-time updates on their trades. The combination of automated monitoring, flexible strategy configuration, and real-time alerts makes it an ideal tool for active traders.

1. Stock Monitoring Program Started

This alert will be sent when the stock monitoring process starts.

[09:15:01] Stock Monitoring Program Started

2. Settings Summary Alert

When the settings are loaded and monitoring starts, the summary of the settings will be sent as an alert.

[09:15:02]

Program Settings:

Telegram Token: [HIDDEN]

Chat ID: [HIDDEN]

Quantity: 100

Threshold: 1.0

Report Interval: 1 minutes

Breakout Times and Loop Counts:

Strategy 1 – Start: 09:15, End: 09:30, Loop Count: 1

Strategy 2 – Start: 09:45, End: 10:00, Loop Count: 1

Selected Stocks:

^NSEI, RELIANCE.NS, TCS.NS, INFY.NS, ITC.NS

Selected Strategies:

Strategy 1: Enabled

Strategy 2: Enabled

Strategy 3: Disabled

Trailing Stop-Loss Enabled: Yes

Exit at First Target: No

3. Breakout Buy Alert

This alert will be sent when a stock reaches the breakout high level and a buy order is suggested.

[09:16:35] Strategy 1 – Buy Alert! 🟢

Stock: RELIANCE.NS

Entry Price: 2500.50

Target: 2520.50

Stop-Loss: 2480.50

LTP: 2501.00

PnL: 50.00 ₹

4. Breakout Sell Alert

This alert will be sent when a stock reaches the breakout low level and a sell order is suggested.

[09:17:20] Strategy 2 – Sell Alert! 🔴

Stock: TCS.NS

Entry Price: 3500.00

Target: 3480.00

Stop-Loss: 3520.00

LTP: 3499.00

PnL: -50.00 ₹

5. Exit Position Alert (Target Hit)

This alert will be sent when a position is closed due to hitting the target price.

[09:18:45] Exit Buy position for RELIANCE.NS at target: 2520.50

Profit: 2000.00 ₹ 👍👍

6. Exit Position Alert (Stop-Loss Hit)

This alert will be sent when a position is closed due to hitting the stop-loss.

[09:19:35] Exit Sell position for TCS.NS at stop-loss: 3520.00

Loss: -2000.00 ₹ 👎👎

7. Trailing Stop-Loss Adjustment

This alert will be sent when the trailing stop-loss is adjusted during an open position.

[09:20:15] Trailing Stop-Loss adjusted for INFY.NS. New SL at 1750.00 😎😎

8. Profit/Loss Report

The periodic profit/loss report summarizes the current state of open and booked positions.

[09:21:00] 📊 *Today’s Trading Summary:*

📈 *Total Trades:* 2

💰 *Net Profit:* 500.00 ₹ 😛😛

✅ *Wins:* 1

❌ *Losses:* 1

*Open Positions:*

• RELIANCE.NS: Entry: 2500.50, Target: 2520.50, SL: 2480.50, LTP: 2510.00, MTM: 950.00 ₹, 🟢 Buy

• TCS.NS: Entry: 3500.00, Target: 3480.00, SL: 3520.00, LTP: 3490.00, MTM: -500.00 ₹, 🔴 Sell

*Booked Positions:*

• INFY.NS: 🟢 Profit: 1500.00 ₹ 😛

• ITC.NS: 🔴 Loss: -1000.00 ₹ 😪

*Net MTM:* 450.00 ₹ 😛😛

These are examples of various alerts you will receive from your application. The alerts cover the initial start of monitoring, buy/sell alerts, position exits, stop-loss adjustments, and periodic profit/loss reports. You can customize the messages further as needed for your trading strategy.

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.